Introduction

Real estate investment has become one of the most popular ways to build long-term wealth and create passive income. Real Estate Investment : A Comprehensive Guide on Real Estate is designed to help investors understand the fundamentals as well as advanced strategies of the real estate market. This comprehensive guide will walk you through everything you need to know about investing in real estate—from basic concepts and property types to smart investment strategies that can help you succeed in today’s dynamic market.

What is Real Estate Investment?

Real estate investment involves purchasing, owning, managing, renting, or selling real estate properties to generate profit. Unlike buying a home to live in, real estate investment focuses on properties that can produce income or appreciate in value over time. This investment strategy has helped millions of people build substantial wealth and achieve financial freedom.

Understanding what real estate is forms the foundation of successful investing. Real estate refers to physical property consisting of land and buildings, along with natural resources like crops, minerals, or water. When you invest in real estate, you’re essentially buying a piece of this physical world that can generate money through rental income, property appreciation, or both.

The beauty of real estate investment lies in its tangible nature. Unlike stocks or bonds, you can see, touch, and improve your investment. This physical presence often provides investors with a sense of security and control that other investment types cannot offer.

5 Simple Ways to Invest in Real Estate

1. Rental Properties

Buying residential or commercial properties to rent out is the most traditional form of real estate investment. You purchase a property, find tenants, and collect monthly rent payments. This method provides steady cash flow and potential property appreciation over time.

Pros:

Regular monthly income

Property appreciation potential

Tax benefits and deductions

Control over your investment

Cons:

High initial capital required

Property management responsibilities

Vacancy risks

Maintenance and repair costs

2. Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without actually buying property. These companies own and operate income-producing real estate, and you can buy shares just like stocks. REITs are perfect for beginners who want exposure to real estate markets without large capital requirements.

3. House Flipping

This strategy involves buying undervalued properties, renovating them, and selling them quickly for profit. House flipping requires good market knowledge, renovation skills, and sufficient capital to handle unexpected costs.

4. Real Estate Crowdfunding

Modern technology has made it possible to invest in real estate projects with smaller amounts of money through crowdfunding platforms. You can pool money with other investors to fund larger real estate projects and receive returns based on the project’s success.

5. Wholesale Real Estate

Wholesaling involves finding distressed properties, getting them under contract, and then selling the contract to other investors for a fee. This method requires minimal capital but demands strong networking skills and market knowledge.

Understanding Different Types of Real Estate Investments

Residential Real Estate

Residential properties include single-family homes, condominiums, townhouses, and small apartment buildings. These properties are typically easier to understand and manage, making them ideal for new investors.

Single-Family Homes: These properties appeal to families and offer stable rental income. They’re easier to finance and sell compared to larger properties.

Multi-Family Properties: Duplexes, triplexes, and small apartment buildings provide multiple income streams from one property. If one unit becomes vacant, you still have income from other units.

Condominiums: Condos offer lower maintenance responsibilities since the homeowners association handles exterior maintenance. However, you’ll pay monthly HOA fees.

Commercial Real Estate

Commercial properties include office buildings, retail spaces, warehouses, and industrial facilities. These investments typically require more capital but can provide higher returns and longer lease terms.

Office Buildings: These properties can provide stable income with long-term leases, but they require professional management and significant capital investment.

Retail Properties: Shopping centers and individual retail spaces can be profitable, but they’re sensitive to economic changes and online shopping trends.

Industrial Properties: Warehouses and manufacturing facilities often have long-term leases and lower maintenance costs, making them attractive to investors.

Raw Land

Investing in undeveloped land can be profitable if you choose locations with growth potential. However, raw land doesn’t generate immediate income and may require years to appreciate significantly.

Getting Started with Real Estate Investment in 2026

Starting your real estate investment journey requires careful planning and preparation. Here’s a step-by-step approach to help you begin:

Step 1: Assess Your Financial Situation

Before investing in real estate, evaluate your current financial position. Calculate your net worth, review your credit score, and determine how much capital you can invest without compromising your financial security.

Key Financial Metrics to Consider:

Credit score (aim for 700+ for better financing options)

Debt-to-income ratio

Available cash for down payments

Emergency fund (6-12 months of expenses)

Stable income source

Step 2: Set Clear Investment Goals

Define what you want to achieve through real estate investment. Are you looking for immediate cash flow, long-term appreciation, or a combination of both? Your goals will determine the best investment strategy for your situation.

Step 3: Choose Your Investment Strategy

Based on your goals and financial situation, select the investment approach that fits your needs. Consider factors like available time, risk tolerance, and capital requirements when making this decision.

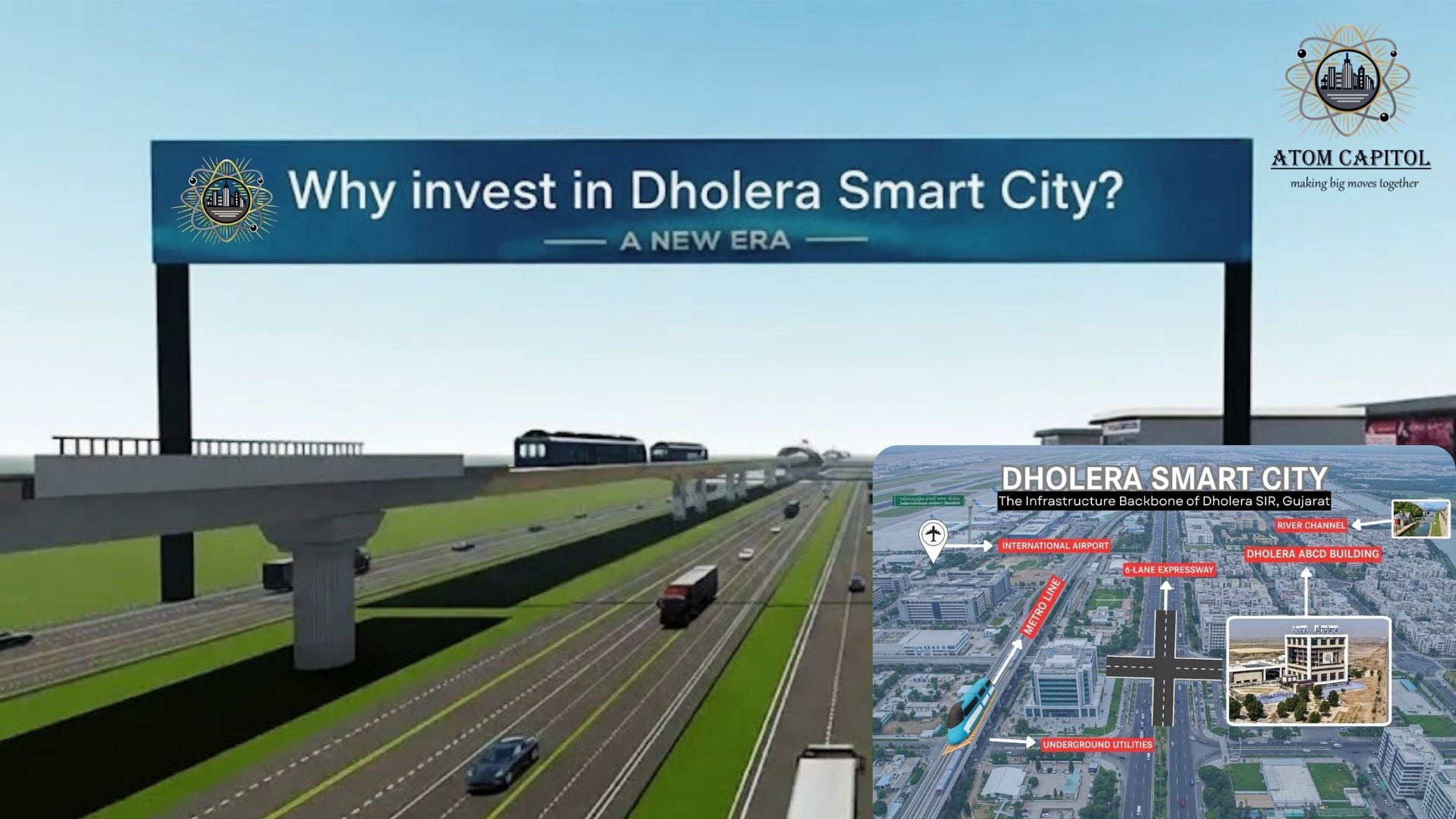

Step 4: Research Markets

Successful real estate investment requires thorough market research. Look for areas with:

Population growth

Job market expansion

Infrastructure development

Good schools and amenities

Reasonable property prices

Step 5: Build Your Team

Real estate investment is rarely a solo endeavor. Build relationships with:

Real estate agents specializing in investment properties

Mortgage brokers or lenders

Property inspectors

Contractors and handymen

Property management companies

Accountants familiar with real estate taxes

Real estate attorneys

Key Benefits of Real Estate Investment

Cash Flow Generation

Well-chosen rental properties can provide steady monthly income that often increases over time. This cash flow can supplement your regular income or serve as your primary income source once you build a sufficient portfolio.

Consider hiring a tax professional who understands real estate investments. The tax benefits and complexity of real estate investing often justify the cost of professional help.

Real estate investment offers tremendous opportunities for building wealth and achieving financial independence. This comprehensive guide to real estate investing provides the foundation you need to start your journey successfully. Remember that successful investing in real estate requires patience, continuous learning, and careful planning. Start with thorough research, begin small, and gradually build your knowledge and portfolio over time.

Whether you choose rental properties, REITs, or other investment strategies, the key to success lies in understanding your market, managing risks effectively, and staying committed to your long-term goals. Take action today by researching your local market and connecting with experienced real estate professionals who can help guide your investment journey.