Introduction

When deciding between Dholera vs GIFT City: Which is Better for Investment, investors face a challenging choice between two of India’s most promising smart city developments. Both Gujarat-based projects offer unique advantages, but understanding their distinct characteristics is crucial for making the right investment decision. This comprehensive Gift City vs Dholera SIR: Which Is Better For Investors & NRIs guide will help you navigate these investment opportunities with detailed analysis and expert insights.

Understanding Dholera Special Investment Region

What is Dholera SIR?

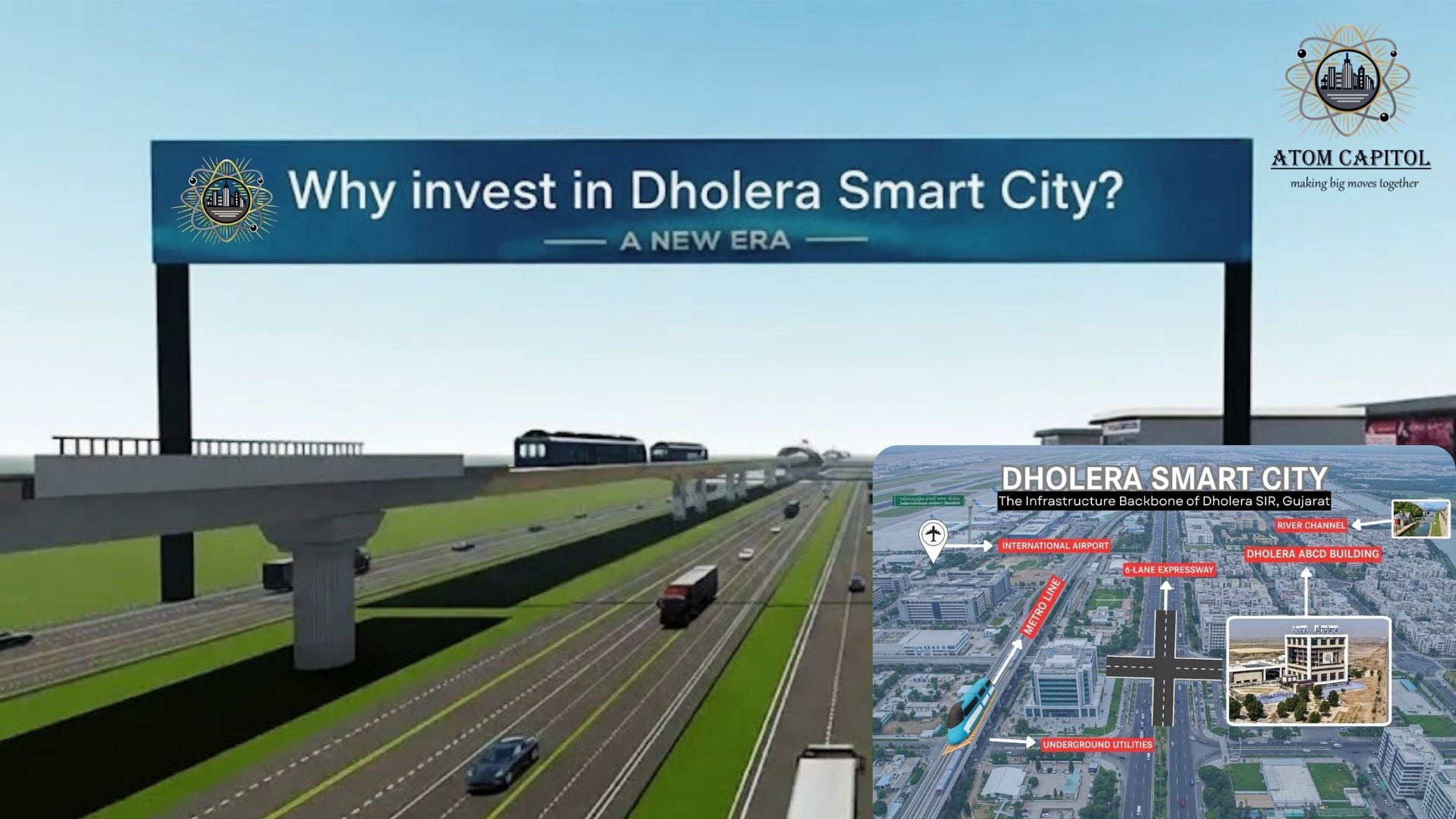

Dholera Special Investment Region represents India’s first smart city project, spanning across 920 square kilometers in Gujarat. This massive development aims to become a global manufacturing and trading hub, designed to accommodate 2 million residents by 2040.

Key Features of Dholera

Strategic Location Benefits:

- Located along the Delhi Mumbai Industrial Corridor (DMIC)

- Close proximity to major ports including Kandla and JNPT

- Excellent connectivity to Ahmedabad (100 km) and Mumbai (600 km)

- Access to dedicated freight corridors

Infrastructure Development:

- Smart grid electricity systems

- Advanced water management and sewage treatment

- High-speed internet connectivity

- Modern transportation networks

- Integrated waste management systems

Investment Sectors in Dholera

The Dholera vs GIFT City: NRI Investment ROI Guide 2025 shows that Dholera focuses on:

- Manufacturing and heavy industries

- Automotive sector development

- Renewable energy projects

- Logistics and warehousing

- Information technology

- Biotechnology and pharmaceuticals

GIFT City Overview and Investment Potential

What Makes GIFT City Special?

Gujarat International Finance Tec-City (GIFT City) stands as India’s first operational smart city and International Financial Services Centre (IFSC). Located between Ahmedabad and Gandhinagar, this 886-acre development focuses on financial services and technology sectors.

Core Advantages of GIFT City

Financial Hub Status:

- India’s first IFSC with regulatory benefits

- Home to major banks and financial institutions

- Special tax incentives for businesses

- International arbitration center

- Advanced trading and settlement systems

Infrastructure Excellence:

- District cooling systems

- Pneumatic waste collection

- Smart building technologies

- Integrated command and control center

- Sustainable urban planning

GIFT City Investment Opportunities

When analyzing Which Is Better for Investment? – Dholera vs GIFT City, GIFT City offers:

- Commercial office spaces

- Residential apartments and villas

- Retail and hospitality sectors

- Financial services businesses

- Technology company setups

Dholera vs GIFT City: Infrastructure Development Comparison

Development Timeline

Dholera Progress:

- Phase 1 development covering 22.5 sq km underway

- Basic infrastructure 70% complete

- International airport construction approved

- Industrial plots allocation ongoing

- Expected full development by 2040

GIFT City Advancement:

- Phase 1 completed with operational buildings

- Over 200 companies already established

- Residential towers occupied

- Phase 2 development in progress

- Faster development pace due to smaller scale

Connectivity Infrastructure

Transportation Links:

| Aspect | Dholera | GIFT City |

|---|---|---|

| Airport | New international airport planned | 30 km from Ahmedabad airport |

| Railway | High-speed rail connectivity planned | Connected to main railway network |

| Highways | Direct access to major highways | Excellent road connectivity |

| Metro | Future metro connectivity | Connected to Ahmedabad metro |

Investment Opportunities and ROI Analysis

Property Investment Returns

Dholera Investment Potential:

- Land prices: ₹800-2000 per sq ft

- Residential plots: ₹1500-3000 per sq ft

- Industrial land: ₹400-800 per sq ft

- Expected appreciation: 15-20% annually

- Long-term ROI: 300-500% over 10 years

GIFT City Investment Returns:

- Office spaces: ₹8000-12000 per sq ft

- Residential units: ₹6000-10000 per sq ft

- Rental yields: 6-8% annually

- Capital appreciation: 10-15% annually

- Established market with immediate returns

Investment Risk Assessment

Dholera Risk Factors:

- Development timeline uncertainties

- Dependency on government execution

- Limited current infrastructure

- Market establishment challenges

- Higher speculative risk

GIFT City Risk Considerations:

- Higher entry costs

- Market saturation potential

- Regulatory changes impact

- Competition from other financial hubs

- Economic cycle dependencies

Government Support and Policy Benefits: Dholera vs GIFT City – Which is Better for Investment?

Dholera Government Initiatives

When analyzing Dholera vs GIFT City: Which is Better for Investment, Dholera’s policy backing stands out due to its scale and long-term vision.

Central Government Support:

Special Investment Region (SIR) status

Single-window clearance system

Dedicated infrastructure funding

Industrial promotion policies

Tax incentives for manufacturing and large enterprises

State Government Benefits:

Land acquisition facilitation

Utility and infrastructure support

Streamlined regulatory approvals

Investment promotion schemes

Skill development and workforce programs

These initiatives make Dholera attractive for long-term, growth-oriented investors evaluating Dholera vs GIFT City: Which is Better for Investment.

GIFT City Policy Advantages

GIFT City offers a different policy ecosystem, especially relevant for financial and institutional investors comparing Dholera vs GIFT City: Which is Better for Investment.

IFSC Benefits:

100% FDI permitted

Simplified regulatory framework

Multiple tax exemptions

Forex trading permissions

International arbitration facilities

Special Economic Zone (SEZ) Benefits:

Duty-free import and export

Income tax exemptions

MAT exemptions

Simplified compliance procedures

Single-point clearance system

Connectivity and Accessibility Factors: Dholera vs GIFT City – Which is Better for Investment?

Dholera Connectivity Development

From an infrastructure timing perspective, connectivity is a key factor in Dholera vs GIFT City: Which is Better for Investment.

Current Status:

State highway connectivity operational

Basic road infrastructure in place

Limited public transport

Nearest airport approx. 100 km (Ahmedabad)

Rail connectivity under development

Future Plans:

Dedicated international airport

High-speed rail corridor

Metro connectivity

Expanded highway networks

Modern public transportation systems

Dholera’s connectivity story strengthens its case for long-term investors assessing Dholera vs GIFT City: Which is Better for Investment.

GIFT City Accessibility

GIFT City currently enjoys superior accessibility, which impacts short-term returns in the Dholera vs GIFT City: Which is Better for Investment debate.

Existing Infrastructure:

Well-developed road networks

Active public bus services

Operational metro connectivity

Proximity to Sardar Vallabhbhai Patel International Airport

Availability of taxis and app-based cab services

NRI Investment Benefits and Tax Implications: Dholera vs GIFT City – Which is Better for Investment?

NRI Investment in Dholera

For NRIs evaluating Dholera vs GIFT City: Which is Better for Investment, Dholera offers compelling long-term advantages.

Investment Benefits:

Foreign exchange advantage

Clear property ownership rights

Fund repatriation allowed

Long-term capital gains potential

Early-stage wealth creation opportunity

Documentation Requirements:

PAN card

NRE/NRO account

FEMA compliance

Property registration

Regular tax filing

GIFT City NRI Benefits

GIFT City is structured for ease of global investment, making it attractive in the Dholera vs GIFT City: Which is Better for Investment comparison.

Special Provisions:

Simplified investment processes

Multiple asset classes

Professional asset management

Regular income generation

Portfolio diversification

Tax Considerations:

TDS on rental income

Capital gains tax on sale

Double taxation avoidance benefits

Professional tax planning recommended

Ongoing compliance monitoring

Risk Assessment: Dholera vs GIFT City – Which is Better for Investment?

Dholera Investment Risks

Understanding risks is essential when deciding Dholera vs GIFT City: Which is Better for Investment.

Key Risks:

Development timeline uncertainty

Market adoption challenges

Infrastructure execution dependency

Economic fluctuations

Policy changes

Risk Mitigation Strategies:

Phased investment approach

Location-based selection

Regular progress monitoring

Professional advisory support

Pre-defined exit strategy

GIFT City Investment Risks

Even established markets have risks in the Dholera vs GIFT City: Which is Better for Investment analysis.

Key Risks:

Market volatility

Competition from other financial hubs

Regulatory changes

Economic cycle sensitivity

Rental yield fluctuations

Risk Management Approaches:

Market research

Professional property management

Insurance coverage

Legal due diligence

Periodic portfolio review

Future Growth Prospects and Market Predictions: Dholera vs GIFT City – Which is Better for Investment?

Dholera Growth Outlook

Short-Term (2024–2027):

Core infrastructure completion

Initial industrial operations

Limited residential supply

Gradual price appreciation

Market formation stage

Long-Term (2027–2040):

Fully operational smart city

Major industrial and logistics hub

Population expansion

Strong capital appreciation

Mature investment ecosystem

This long-term trajectory strongly supports Dholera in the Dholera vs GIFT City: Which is Better for Investment discussion for patient investors.

GIFT City Development Forecast

Near-Term (2024–2026):

Continued business expansion

Infrastructure upgrades

Rising asset values

Strong rental demand

Global recognition

Future Potential (2026–2035):

Regional financial hub leadership

Technology and fintech expansion

Sustainable urban model

Premium real estate market

Global investor participation

Expert Recommendations by Investor Profile: Dholera vs GIFT City – Which is Better for Investment?

Conservative Investors

GIFT City Preference:

Established ecosystem

Immediate rental income

Lower execution risk

Professional asset management

Stable appreciation

Growth-Oriented Investors

Dholera Opportunity:

Higher appreciation potential

Early-entry advantage

Large-scale development vision

Strong government backing

Long-term wealth creation

NRI Investors

Balanced Strategy Recommended:

Diversification across both Dholera and GIFT City

Risk-adjusted return optimization

Currency and tax planning

Professional management

Flexible exit planning

Final Verdict: Dholera vs GIFT City – Which is Better for Investment?

The answer to Dholera vs GIFT City: Which is Better for Investment depends entirely on your goals, risk appetite, and time horizon.

GIFT City suits investors seeking stability, immediate income, and lower risk.

Dholera favors investors aiming for high long-term appreciation and early-stage growth.

For many investors—especially NRIs—a balanced portfolio across both cities offers the best of both worlds: short-term stability from GIFT City and long-term wealth creation from Dholera.

Both destinations reflect Gujarat’s vision for smart urban development and India’s evolving economic future. With proper due diligence, strategic planning, and professional guidance, either choice—or a combination of both—can be rewarding.

Ready to decide?

Contact our property investment experts today for personalized guidance and exclusive opportunities in Dholera and GIFT City.

👉 Invest smart. Choose strategically. Grow confidently.