Buyer-First Guide to Protecting Your Real Estate Investment

In real estate, price excites people—but legality protects them. Legal Verification of Property is often overlooked, even though it is the backbone of a safe investment.

Many property buyers spend weeks comparing prices, locations, and future returns, yet spend only minutes reviewing legal documents. This imbalance is the reason why property disputes remain one of the largest sources of financial stress and long-term litigation in India.

Legal verification is not a formality. It is the foundation of ownership.

This guide goes beyond a basic checklist. It explains:

Why each legal step matters

What risks it prevents

How buyers should think like professionals, not just purchasers

If you want peace of mind, liquidity, resale value, and generational security—this guide is essential.

What Is Legal Verification of Property (And Why It’s More Than Paperwork)

Legal verification is the process of confirming that:

The seller has legal authority to sell

The property is free from disputes, claims, and violations

The land or building complies with local laws and planning rules

Your ownership will be legally enforceable in court

📌 A property is not truly “yours” until the law recognizes it as yours.

The Right Time to Start Legal Due Diligence

Many buyers make the mistake of verifying documents after paying a token amount.

Correct approach:

Start verification before booking

Reconfirm before signing the Agreement to Sell

Final check before registration

🚫 Never rush legal checks due to discounts, pressure tactics, or “limited-time offers”.

Step One: Confirm Legal Ownership (Not Just Possession)

Possession does not equal ownership.

You must verify:

Who is the legal owner?

Is the property freehold or leasehold?

Are there multiple owners or heirs?

Does the seller have absolute selling rights?

Key ownership documents:

Sale Deed

Conveyance Deed

Gift Deed / Will

Partition Deed (for ancestral property)

💡 Ownership must be clear, complete, and uncontested.

Title Clarity: The Backbone of Legal Verification of Property

Title clarity is the foundation of legal verification of property. A “clear title” confirms that ownership is lawful, uninterrupted, and free from disputes.

A clear title means the property:

Has a lawful ownership history

Was transferred legally at every stage

Has no hidden claims or ownership disputes

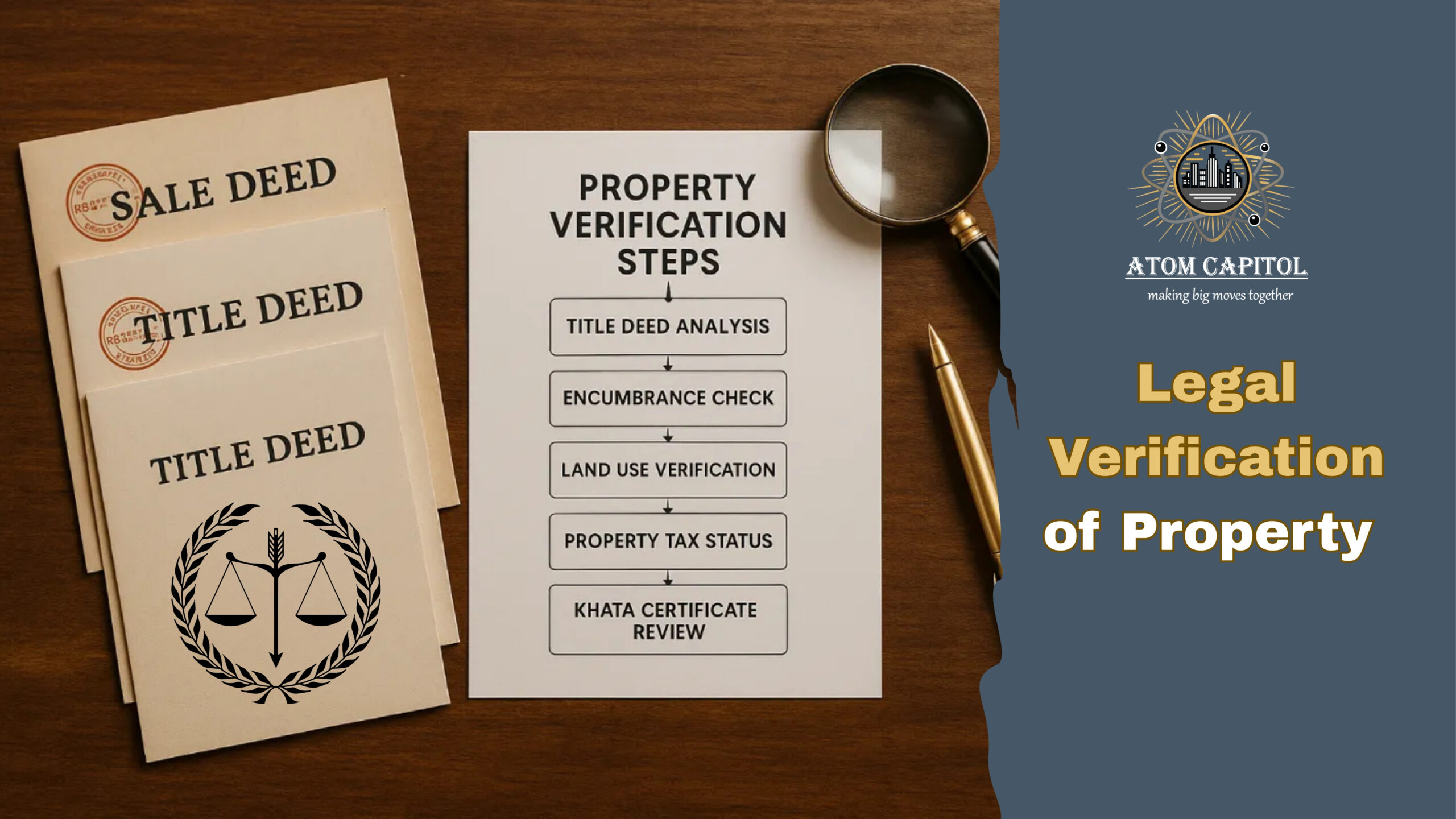

What Professionals Check During Legal Verification of Property

Title continuity for at least 30 years

Legitimacy of each ownership transfer

Absence of forged, missing, or incomplete deeds

📌 If title history is broken, ownership can be challenged—even decades later—making legal verification of property non-negotiable.

Encumbrance Certificate: Your Debt & Liability Detector in Legal Verification of Property

An Encumbrance Certificate (EC) is a critical document in legal verification of property. It reveals whether the property carries any financial or legal burden.

EC discloses:

Loans or mortgages

Court attachments

Financial or third-party claims

Best Practices for Legal Verification of Property

Obtain EC for at least 20–30 years

Ensure it shows “Nil Encumbrance”

Cross-verify with bank records if past loans existed

🚫 Never rely on verbal assurances—only EC validates clean ownership during legal verification of property.

Land Use & Zoning: A Critical Step in Legal Verification of Property

Buying land without zoning clarity is one of the costliest mistakes in legal verification of property.

You must verify:

Residential / Commercial / Industrial zoning

Compliance with Master Plan

Development authority permissions

For Land Purchases

Agricultural vs Non-Agricultural (NA) status

NA conversion approvals (if applicable)

📌 Incorrect land use can block construction, bank loans, and resale—making zoning checks essential in legal verification of property.

Government Approvals & Sanctions: Legal Verification of Property Beyond Documents

A structure may exist physically yet still fail legal verification of property.

Mandatory approvals include:

Approved layout plan

Sanctioned building plan

Environmental clearance (for large projects)

Fire safety NOC (commercial / high-rise)

Completion Certificate (CC)

Occupancy Certificate (OC)

💡 Without an OC, even a fully built property can be declared unauthorized—highlighting why approvals matter in legal verification of property.

Mutation & Revenue Records: Administrative Proof in Legal Verification of Property

Mutation updates ownership records in:

Municipal databases

Revenue department records

Why Mutation Matters in Legal Verification of Property

Confirms government recognition

Required for property tax and utility connections

Essential for resale and inheritance

📌 Registration transfers ownership—but mutation completes legal verification of property administratively.

Property Tax & Utility Dues: Hidden Risks in Legal Verification of Property

Before purchase, legal verification of property must include checking outstanding dues.

Always verify:

Property tax payment history

Electricity and water bills

Society or maintenance charges

🚫 Outstanding dues legally transfer to the buyer after purchase if ignored during legal verification of property.

Litigation Search: What Courts Reveal During Legal Verification of Property

A property can be legally risky even if documents look clean.

Search records for:

Civil court cases

High Court litigation

Local legal notices

Revenue court disputes (especially for land)

📌 Even one unresolved case can freeze resale and financing for years—making litigation checks vital in legal verification of property.

Agreement to Sell: Your Legal Shield in Legal Verification of Property

The Agreement to Sell is not a formality—it is your strongest protection in legal verification of property.

Must-Have Clauses

Exact property description

Payment milestones

Possession timeline

Penalties for default

Exit and refund conditions

Approval responsibilities

Dispute resolution mechanism

💡 Never sign an agreement without professional legal review—this step finalizes legal verification of property in practice.

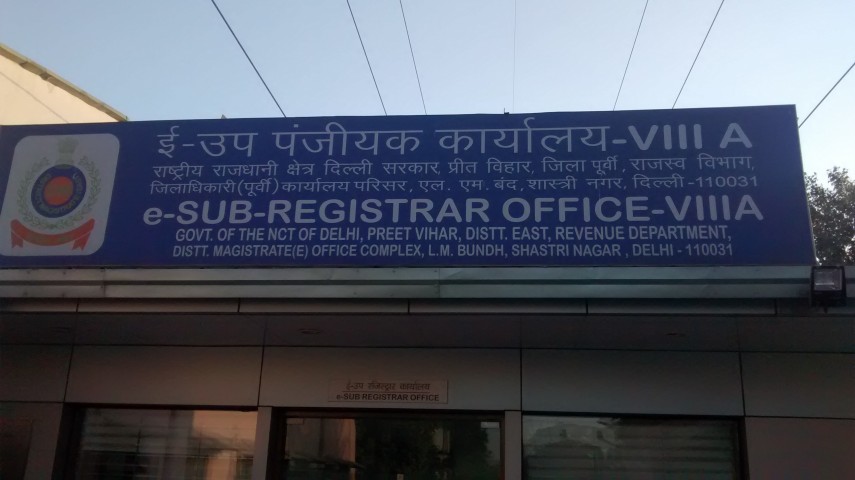

Stamp Duty & Registration: When Ownership Becomes Legal

Legal ownership transfers only after:

Correct stamp duty payment

Sale Deed registration at Sub-Registrar Office

Verify:

Circle rate compliance

Accurate buyer–seller details

Correct survey number / unit details

🚫 Unregistered documents have no legal standing.

Power of Attorney Transactions: High-Risk Zone

If the sale involves Power of Attorney (PoA):

Ensure PoA is registered

Confirm it includes sale rights

Verify the principal owner is alive

Avoid general or outdated PoAs

📌 Improper PoA deals are a major source of property fraud.

Bank Loans, NOCs & Third-Party Consents

Check for:

Bank NOC if loan existed

Society NOC (for apartments)

Developer approvals (for under-construction projects)

💡 Banks do legal checks—but never rely on them alone.

Red Flags Smart Buyers Never Ignore

❌ Pressure to close quickly

❌ Missing original documents

❌ Cash-heavy transactions

❌ “Approval under process” excuses

❌ Agricultural land sold as residential

❌ Reluctance to share documents

📌 If transparency is missing—walk away.

Why a Property Lawyer Is Non-Negotiable

A property lawyer:

Reads beyond surface documents

Identifies future litigation risks

Protects enforceable ownership

Saves years of court battles

💡 Legal fees are small; legal mistakes are permanent.

Ultimate Legal Verification Checklist

✔ Clear ownership title

✔ 30-year title chain

✔ Nil Encumbrance Certificate

✔ Correct land use & zoning

✔ All statutory approvals

✔ Mutation & revenue records

✔ Tax & utility clearance

✔ No litigation

✔ Registered Sale Deed

✔ Proper stamp duty paid

Final Insight: Legal Clarity Is the Real Asset

A beautiful property without legal clarity is not an asset—it is a risk waiting to surface.

But a legally verified property:

Protects your capital

Ensures peace of mind

Enables resale and financing

Secures your family’s future

In real estate, paperwork creates ownership—not possession.

Before you invest money, invest time in legal verification. It is the smartest, safest, and most professional decision a property buyer can make.

Need Expert Help for Property Legal Verification?

Work with professionals who verify every document, every approval, and every risk—so you buy not just property, but certainty.

Verify First. Buy Confidently. Own Securely.