Why Location Is Not a Factor — But a Force Multiplier (and How The Aurelias Fits Perfectly)

In real estate, investors often focus on price, size, construction quality, or short-term returns. Yet, history repeatedly proves one timeless truth:

Location is not one of many factors in real estate investment.

It is the force that multiplies or nullifies every other factor.

You can renovate a building.

You can redesign interiors.

You can even change the use of a property.

But you can never change where it is located.

This blog takes a fresh, strategic, and future-oriented perspective on location—going beyond clichés to explain how location works as a system, how professionals evaluate it, and how investors can apply this knowledge to real opportunities like The Aurelias.

1. Location Is an Ecosystem, Not a Spot on the Map

Most people think location means a city name or a nearby landmark. Smart investors know better.

A strong real estate location is a living ecosystem where:

People want to live and work

Jobs continuously attract migration

Infrastructure enables smooth movement

Governance supports long-term planning

Demand sustains and compounds value

📌 When the ecosystem is strong, property values grow even during slow market cycles.

2. The “WHY HERE?” Rule That Smart Investors Never Ignore

Before asking “How much does it cost?”, professionals ask:

Why does this location exist?

Strong locations exist because of:

Employment generation

Trade and logistics advantage

Strategic connectivity

Lifestyle and livability

Government-backed vision

Weak locations exist only because land was available cheaply.

💡 If you cannot clearly explain why people will live or work here, the investment is driven by hope—not fundamentals.

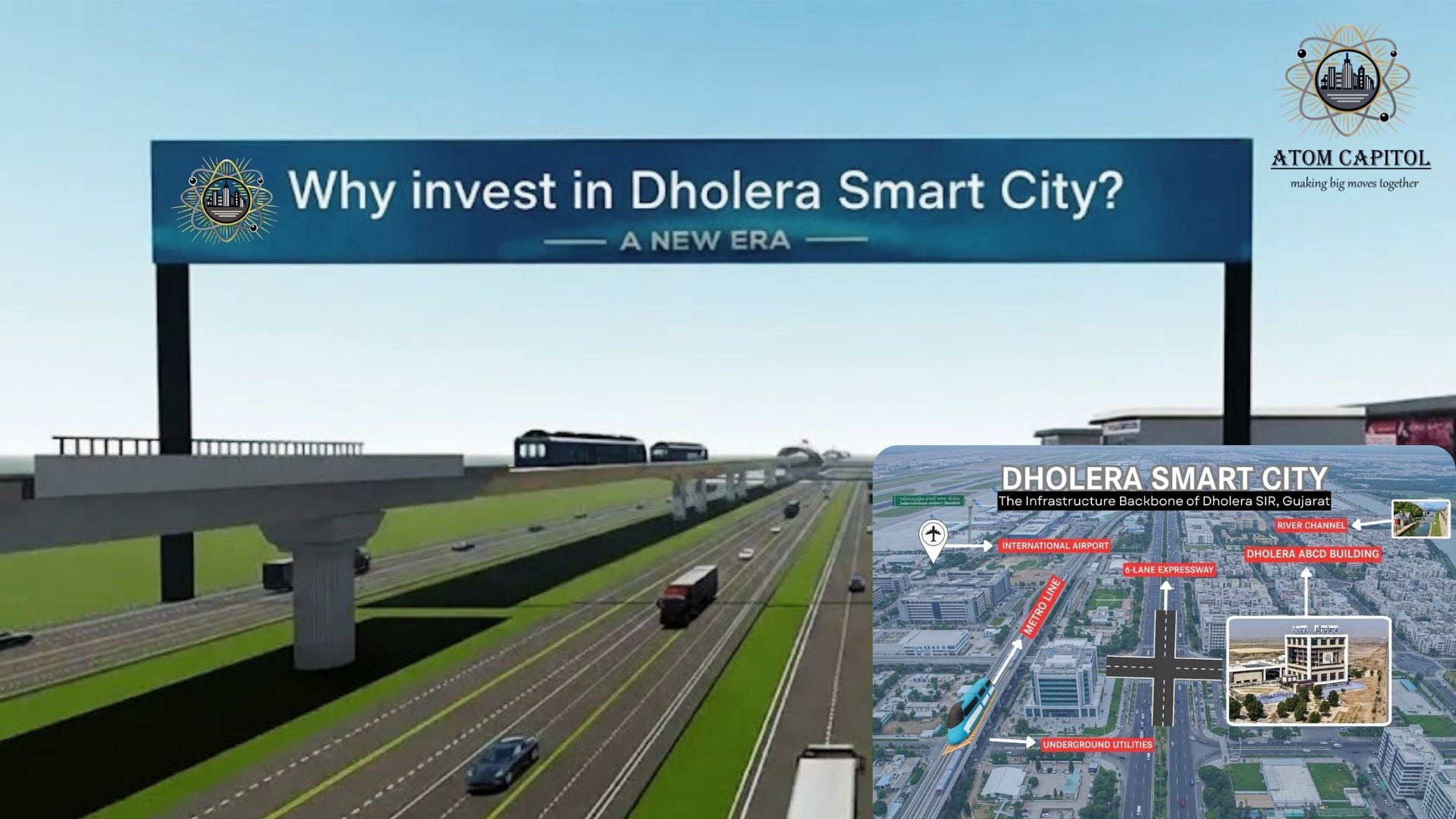

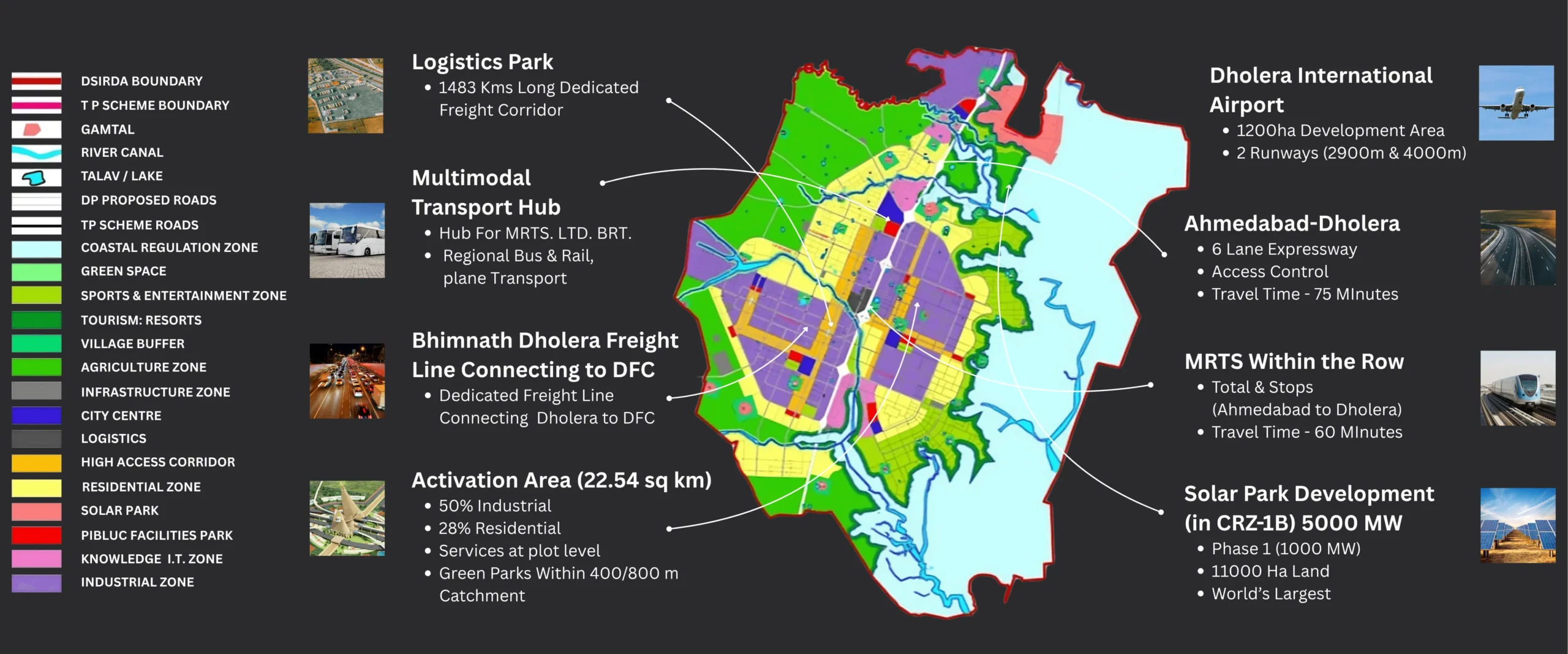

3. Infrastructure: How Governments Signal the Future

Infrastructure is not convenience—it is economic intent.

When governments invest in:

Expressways and industrial corridors

Metro and rapid transit systems

Airports and logistics hubs

Utility grids (power, water, digital)

they are clearly indicating where growth will concentrate.

📌 Real estate appreciates where access improves, not where promises are loudest.

4. Employment Gravity: The Hidden Engine of Demand

Real estate demand does not appear magically. It follows jobs.

Locations near:

Industrial clusters

IT and business parks

Manufacturing zones

Economic corridors

show:

Higher absorption

Strong rental demand

Faster appreciation

💡 Locations without employment drivers depend on speculation—and speculation has no long-term loyalty.

5. Time Is the New Distance

In modern cities, time has replaced kilometers.

A home 25 km away that takes 30 minutes is more valuable than one 8 km away that takes 90 minutes.

Smart investors analyze:

Peak-hour travel time

Road capacity and scalability

Public transport access

Last-mile connectivity

📌 Accessibility defines desirability more than geography.

6. Social Infrastructure: The Silent Value Creator

Strong locations offer:

Quality schools and hospitals

Retail, markets, and daily conveniences

Parks, open spaces, and recreation

Community and lifestyle balance

💡 These factors may not create hype, but they create permanent end-user demand.

7. Safety, Environment & Emotional Comfort

Location value is as emotional as it is financial.

Buyers subconsciously evaluate:

Safety and security

Cleanliness and maintenance

Noise and pollution levels

Flood or environmental risk

Neighborhood reputation

📌 Perceived safety often matters as much as actual infrastructure.

8. Future Maps Create Present Wealth

Professional investors buy what is inevitable tomorrow.

They track:

Government master plans

Smart city projects

Zoning upgrades

Industrial and logistics corridors

💡 The highest returns come from locations that are planned, not merely popular.

9. Supply Discipline: Growth Needs Control

Even the best location can underperform if supply is unchecked.

Oversupply dilutes appreciation

Unplanned growth reduces pricing power

Balanced supply sustains long-term value

📌 Scarcity in a strong location is a wealth accelerator.

10. Rental Logic: Location Protects Cash Flow

Rental income depends on tenant convenience, not construction cost.

High-performing rental locations:

Near employment and transit

Offer walkable amenities

Reduce daily friction

💡 Strong rental demand protects investors during slower resale cycles.

11. Liquidity: The Ultimate Test of Location

Liquidity answers one brutal question:

“If I sell tomorrow, how fast will buyers appear?”

Well-located properties:

Sell faster

Attract diverse buyers

Retain value during downturns

🚫 Poorly located assets often require heavy discounts—even in good markets.

12. Location as Risk Management

Strong locations absorb shocks:

Market corrections

Policy changes

Interest rate cycles

Weak locations magnify them.

📌 Location is your insurance policy in real estate investment.

13. The Location Lifecycle Framework

Every location passes through stages:

Emerging

Developing

Mature

Saturated

Each stage offers different risk–reward dynamics.

💡 Long-term wealth is often created by entering early-stage but well-planned locations.

14. The Professional Location Audit (Quick Checklist)

Before investing, ask:

Why does this location exist?

What infrastructure supports it?

What jobs sustain demand?

How easy is daily access?

Who is the end-user?

Is supply controlled?

What future plans are approved?

How liquid is resale?

If answers are unclear—pause.

From Strategy to Opportunity: Introducing The Aurelias

Strategically positioned in the Dholera region, close to India’s first greenfield smart city—Dholera Smart City—The Aurelias is designed for investors who believe in location-led growth, not short-term speculation.

Why The Aurelias Reflects the Power of Location

The Aurelias is a thoughtfully planned residential plotting project located in the rapidly developing Dholera region, strategically aligned with the long-term vision of India’s first greenfield smart city. It is designed for investors and end-users who believe in location-led wealth creation, not short-term speculation.

How The Aurelias Gets Location Right

✔ Strategic Placement

Situated close to major infrastructure corridors, The Aurelias benefits from proximity to expressway connectivity and upcoming economic zones—key drivers of future appreciation.

✔ Future-Growth Orientation

The project aligns with planned urban expansion, industrial development, and residential demand expected to rise as Dholera matures into a global manufacturing and smart city hub.

✔ Clear, Residential-Focused Planning

Designed specifically for residential use, The Aurelias offers plotted development that supports long-term holding, future construction, and strong resale potential.

✔ Infrastructure-Led Appreciation

With access to wide internal roads, planned amenities, and connectivity advantages, the project reflects the principle that infrastructure creates value before buildings do.

✔ Ideal for Long-Term Investors

The Aurelias is especially suited for investors who understand that the biggest real estate gains come from entering the right location early and holding patiently.

The Aurelias: More Than a Plot—A Location Strategy

In real estate, projects come and go—but locations with vision endure. The Aurelias is not positioned as a quick-return scheme; it is positioned as a location-backed asset that grows alongside Dholera’s transformation over the next decade.

If you believe in:

Infrastructure-driven growth

Government-planned urban expansion

Long-term capital appreciation

Owning land in an emerging smart city ecosystem

then The Aurelias offers a compelling opportunity to translate insight into action.

Final Word

Location is not just where you buy—it’s why your investment succeeds.

With its strategic positioning, future-ready planning, and alignment with Dholera’s long-term growth story, The Aurelias represents a smart step for investors who want to build wealth systematically, securely, and sustainably.

👉 Explore The Aurelias today and secure your place in a location designed for tomorrow.

Invest early. Invest wisely. Invest where the future is being built.