The Most Detailed, Practical & Future-Focused Buyer’s Guide (2026 Edition)

Dholera is no longer just a future vision—it is rapidly transforming into India’s most ambitious smart city experiment. With massive government backing, large-scale industrial investments, and next-generation infrastructure taking shape, 2026 stands out as a decisive year for land buyers. However, before taking an investment decision, it is crucial to understand the key legal, infrastructural, and planning aspects that can directly impact your returns. Things You Must Check Before Buying Land in Dholera 2026 is not just a checklist—it’s a smart investor’s guide to securing a safe, high-growth, and future-ready asset in India’s fastest-developing smart city.

But here’s the reality most people don’t talk about:

Dholera can be a goldmine—or a costly mistake—depending on how well you evaluate your land purchase.

This guide goes far beyond generic advice. It is written for serious investors, professionals, NRIs, and long-term planners who want clarity, safety, and strategic advantage.

Why 2026 Is a Critical Year for Buying Land in Dholera

Before we jump into the checklist, it’s important to understand why timing matters.

By 2026:

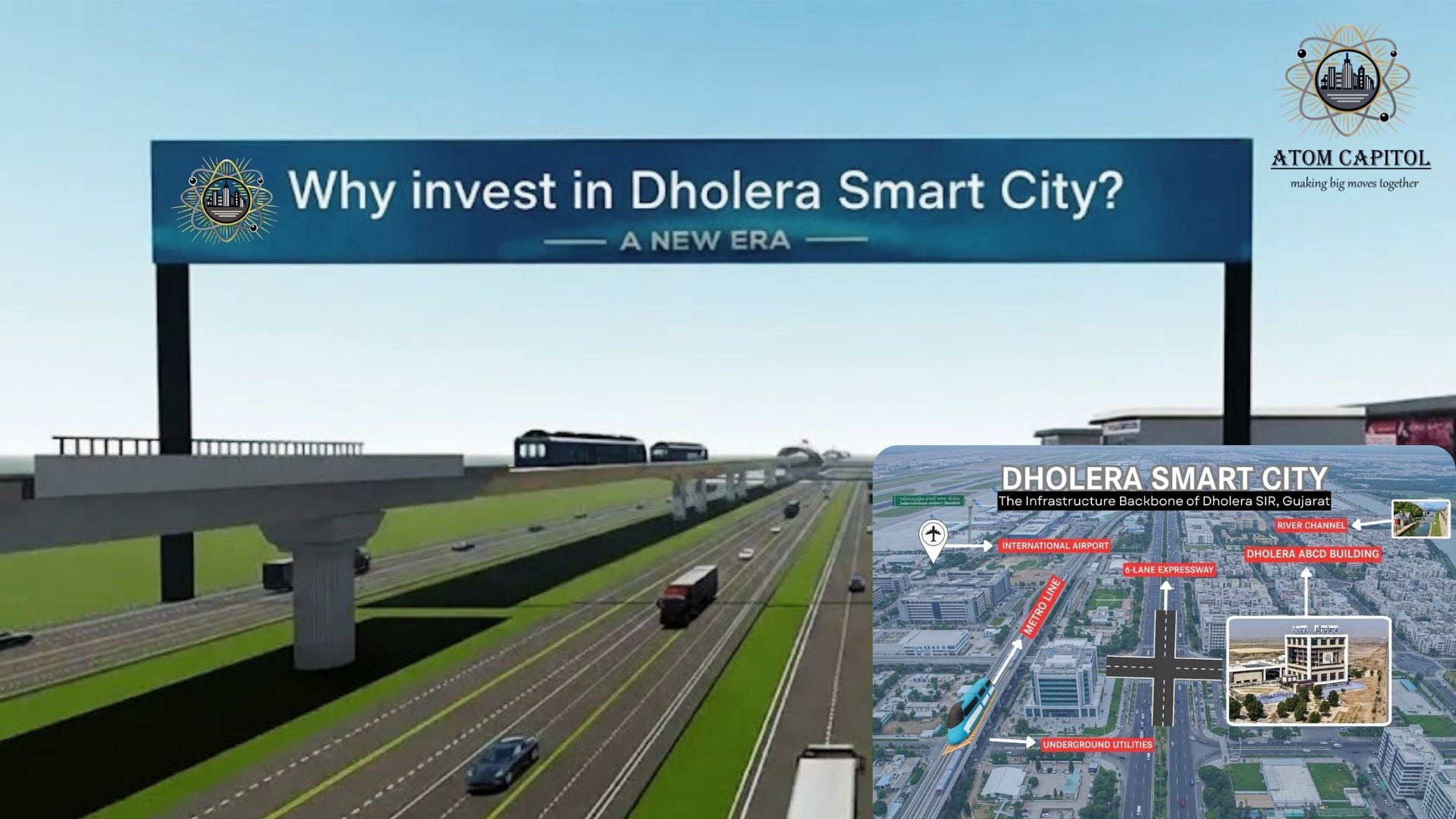

Core infrastructure is visibly operational

Airport & expressway connectivity reach advanced stages

Industrial plots begin attracting workforce housing demand

Speculative pricing starts converting into fundamental value

This means mistakes become expensive, and well-researched plots multiply faster.

1. First Principle: Understand Dholera Beyond Marketing Brochures

Most buyers make their first mistake here.

Dholera is not a single township—it is a carefully zoned Special Investment Region (SIR) spanning villages, industrial belts, activation areas, and residential corridors.

You must clearly understand:

Difference between Dholera SIR vs. nearby villages

Government-planned zones vs. private layouts

Activation Area vs. Non-activation Area

Phased development timeline (short, mid, long term)

📌 Golden Rule:

If someone cannot explain Dholera’s planning structure clearly, don’t buy from them.

2. Confirm One Thing First: Is the Land Inside Dholera SIR?

This is the foundation check—everything else comes later.

Many projects use terms like:

“Near Dholera”

“Dholera Touch”

“Dholera Region”

But only land inside the officially notified Dholera SIR benefits from:

Government infrastructure

Planned utilities

Long-term appreciation certainty

How to verify:

Ask for Survey Number

Match it with the Dholera SIR Master Plan

Verify through official zoning maps or local authority data

🚫 If the seller avoids survey details—walk away.

3. Zoning Intelligence: Residential, Industrial or Mixed Use?

Zoning determines what you can legally do with the land—now and in the future.

Key zoning types:

Residential Zone – For homes, villas, apartments

Industrial Zone – Manufacturing, warehouses

Commercial Zone – Offices, retail, hospitality

Green / Buffer Zone – Limited development

📌 Buying land without understanding zoning is like buying a car without knowing the engine.

4. NA Status: The Legal Line Between Dream & Delay

In Gujarat, Non-Agricultural (NA) status is crucial.

Check clearly:

Is the land already NA?

If agricultural, is NA applied or approved?

Is NA mentioned in the agreement & sale deed?

🚩 Many investors get stuck for years because NA conversion was “promised” but never delivered.

5. Title Clarity & Ownership Chain (Non-Negotiable)

A clean title is more important than price.

Insist on:

Clear ownership documents

Proper title chain (minimum 30 years if possible)

No litigation, loan, or acquisition notice

Encumbrance Certificate verification

📌 Professional tip:

Always involve a property lawyer familiar with Gujarat land laws.

6. Government Acquisition & Planning Risk Check

Dholera is government-planned—which is good—but it also means:

Certain lands are earmarked for future infrastructure

Some parcels may be reserved for utilities, roads, or public use

You must check:

Whether the land is marked for acquisition

Whether it lies on future road alignment

Whether compensation rules apply

Smart investors avoid land that government might need later.

7. Infrastructure Proximity: Distance = Value Multiplier

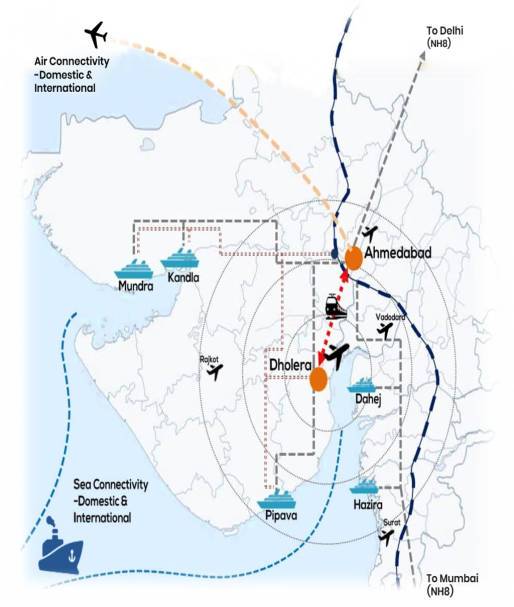

Prioritize proximity to:

Dholera International Airport

Ahmedabad–Dholera Expressway

Metro & freight corridors

ABCD Building (administrative & business core)

Utility corridors (power, water, ICT)

📌 1–3 km difference today can mean 2–3x price difference tomorrow.

8. Developer Due Diligence: Trust Is Built on Records, Not Ads

Dholera has attracted both credible developers and opportunists.

Verify developer:

Past projects & delivery history

RERA compliance (if applicable)

Layout approval documents

Transparency in documentation & pricing

🚩 Avoid:

“Guaranteed returns” promises

Pressure tactics

Cash-heavy transactions

No physical site access

9. Layout Approval & Ground Reality Check

Paper plans mean nothing without execution.

Physically verify:

Actual road width vs. brochure

Plot demarcation on ground

Drainage, leveling & access

Electricity & water planning

📌 Visit the site personally—or send a trusted local representative.

10. Pricing Logic: Cheap Can Be Costly

Low price is attractive—but ask why it’s low.

Smart pricing analysis:

Compare per sq. yd. within same zone

Evaluate development readiness

Check future connectivity timelines

Factor holding cost vs. appreciation

💡 The best investment is fairly priced land with high certainty, not the cheapest plot.

11. Payment Structure & Cost Transparency

Ask for all-inclusive pricing clarity.

Must include:

Base land cost

Development charges

GST (if applicable)

Stamp duty & registration

Future maintenance or corpus fund

📌 Hidden charges kill returns.

12. Registration, Mutation & Legal Closure

Ensure:

Registered sale deed (not just agreement)

Correct stamp duty paid

Mutation completed in revenue records

Buyer name updated officially

🚫 Unregistered land = zero ownership.

13. Exit Strategy: One of the Key Things You Must Check Before Buying Land in Dholera 2026

Smart investors always plan their exit before entry. One of the most overlooked yet critical things you must check before buying land in Dholera 2026 is how you will monetize the land in the future.

Ask yourself clearly:

Will I resell after major infrastructure completion?

Will I construct and earn rental income?

Am I targeting long-term capital appreciation?

Is joint development with a builder a future option?

📌 Things you must check before buying land in Dholera 2026 include having a defined exit plan.

Land without a clear exit strategy is not an investment—it’s a gamble.

14. Appreciation Drivers (2026–2035 Outlook): Core Things You Must Check Before Buying Land in Dholera 2026

Understanding future appreciation drivers is among the most important things you must check before buying land in Dholera 2026. Dholera’s growth trajectory is backed by strong macro and infrastructure fundamentals.

Key appreciation drivers include:

Operational international airport and cargo logistics

Semiconductor fabrication and manufacturing clusters

Rising workforce housing demand

Global supply chain shift toward India

Smart city infrastructure and livability index

When evaluating things you must check before buying land in Dholera 2026, recognizing these drivers helps you stay patient during the holding period and exit profitably at the right time.

15. Ultimate Buyer Checklist (Save This): Things You Must Check Before Buying Land in Dholera 2026

Before making the final payment, this checklist covers the most essential things you must check before buying land in Dholera 2026:

✔ Land is located inside Dholera SIR boundaries

✔ Zoning classification is clearly confirmed

✔ NA (Non-Agricultural) status is verified

✔ Clean title and Encumbrance Certificate (EC)

✔ Approved project layout and planning

✔ Transparent and documented pricing

✔ Registered sale deed completed

✔ Mutation process initiated

Skipping any of these things you must check before buying land in Dholera 2026 can expose you to long-term legal or financial risk.

Final Verdict: Things You Must Check Before Buying Land in Dholera 2026 Decide Your Returns

Dholera in 2026 represents a once-in-a-generation opportunity—but only for informed, patient, and strategic buyers.

Those who focus on the right things you must check before buying land in Dholera 2026, and who:

Verify all legal aspects

Think strategically about exit and holding period

Choose growth-oriented locations

Work with credible and transparent experts

…will benefit the most from India’s smartest city growth story.

Speed creates mistakes.

Knowledge creates wealth.

Ready to Act on the Right Things You Must Check Before Buying Land in Dholera 2026?

If you’re looking for:

Location-wise growth analysis

Legal verification and zoning clarity

Future appreciation mapping

Unbiased expert guidance

Then ensure you follow all things you must check before buying land in Dholera 2026 before making your move.

👉 Know More | Verify Before You Buy | Invest with Confidence in Dholera